Support the Lifespace Foundation and Unlock Financial Benefits with a Charitable Remainder Trust

Save Taxes, Enjoy a Lifetime Income, and Benefit Charity

For decades, families have used charitable remainder trusts to:

- Reduce income taxes

- Convert assets like stock, real estate or other investments into a lifetime income

- Bypass capital gains tax

- Benefit meaningful charities

- Make a gift now or in a will

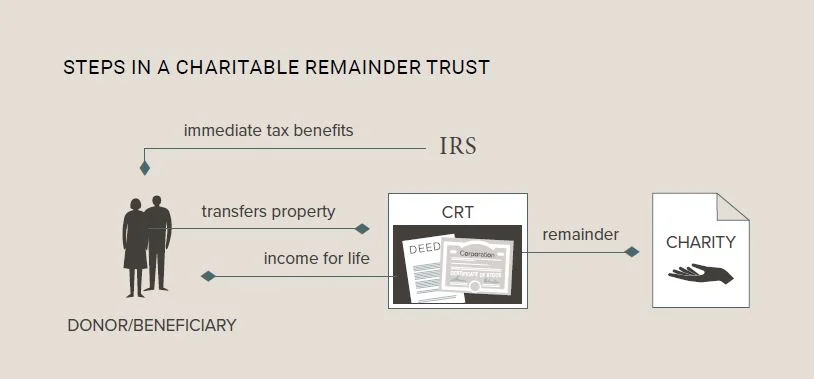

How Does a Charitable Remainder Trust Work?

You transfer money or property to a trust. This removes the property from your estate and allows you to enjoy an immediate income tax deduction if you itemize. The trustee pays you a lifetime income (the trustee sells any appreciated property free of capital gains tax to make the payments). When you die, the remaining assets (the “remainder”) are transferred to us or other named charities.

- An individual transfers property to a CRT, paying no immediate capital gains taxes and qualifying for immediate income tax benefits.

- The trustee invests the property and the trust pays an annual income to the beneficiaries for life (or for a set number of years).

- When the payments end, the trust distributes the remaining assets to the selected charities.

You name the trust beneficiaries—yourself, your spouse, or anyone you choose. The trustee makes annual income payments for as long as the designated beneficiaries live, or for a specific term of years up to 20. These income payments are based on the value of the trust assets (either at the time the trust is created or varying from year to year). When the trust term ends, the trustee pays out the remaining assets to the designated charities.

A CRT IN ACTION*

Genevieve transfers highly appreciated assets worth $400,000 to a charitable remainder trust, specifying that $20,000 will be paid to her each year for as long as she lives. When Genevieve dies, the remaining property will be distributed to us.

By using a CRT, Genevieve reaps a number of benefits:

-

- She secures a lifetime income of $20,000 per

- She realizes an immediate and substantial income tax savings if she itemizes, since she can deduct the present value of our charitable remainder interest.

- She pays no capital gains tax when she transfers her highly appreciated property, or even when the trustee sells the property.

BENEFIT #1

Secure a Lifetime Income

The primary benefit of a charitable remainder trust is to provide income to trust beneficiaries for life (or for a set period up to 20 years). The income can be a fixed amount or a fixed percentage of the value of the trust as calculated yearly. This second option provides an income that rises or falls with the value of the trust assets, with the hope being, of course, that payments will rise and serve as a hedge against inflation.

You can choose a payout amount that accomplishes your targeted objectives—within limits. The payout rate must be at least 5% (not to exceed 50%) of the trust value, and the present value of the charitable remainder amount must be at least 10% of the fair market value of the initial trust assets.

* All examples are for illustrative purposes only.

BENEFIT #2

Qualify for an Immediate Income Tax Deduction

An obvious tax benefit of a charitable remainder trust is an itemized federal income tax deduction. Even though the charities do not receive funds until all income interests are terminated, you can deduct the present value of the deferred charitable interest, subject to limitations of federal tax law.

Computing the charitable deduction depends in part on the applicable federal rate (AFR). You can choose to use the rate in the month of the gift or in either of the two preceding months. Generally, the higher the AFR, the larger the charitable deduction. It would be our pleasure to provide you with the estimated deduction for a proposed gift.

BENEFIT #3

Spread Out Capital Gains Tax

Converting a non-producing asset into an income-producing property without incurring immediate capital gains tax is a distinct benefit. If you fund a charitable remainder trust with appreciated property, you do not owe any capital gains tax when you transfer the property to the trust. The trustee can sell the appreciated property and reinvest the full amount of the proceeds, producing a high income inside the trust. You pay the capital gains tax on the sale of the asset only as the money is distributed.

CONVERTING AN ASSET INTO INCOME

Peter, age 75, owns a low-dividend-paying stock worth $300,000. It has appreciated dramatically since he bought it years ago for $50,000. Peter could sell the stock outright and invest the proceeds, but he would incur a capital gains tax of $37,500 (15% rate). If he invests the after-tax sales proceeds of $262,500 in CDs earning 4%, he would realize an income of $10,500 that year.

However, Peter could instead transfer the stock to a charitable remainder trust that will pay him $15,000 (5%) a year for 20 years. He would not pay capital gains tax on the appreciation at the time of transfer—it would be due instead on a portion of each annual payment, spread out over time. Peter would also receive an income tax charitable deduction of $125,122 if he itemizes.*

The tax savings and the annual lifetime payouts make a charitable remainder annuity trust a satisfying option for Peter.

* Example assumes an AFR of 5.8% and an annual payout.

A Final Note

Beyond the countless benefits to society, there are many reasons to consider a charitable remainder trust—to create an income stream during retirement, dispose of highly appreciated assets in a tax-efficient manner, or create a family giving tradition.

We would be pleased to talk to you about how you can tailor a charitable remainder trust to meet your specific personal or family needs. In the meantime, if you have any questions or if we can be of service in any way, feel free to contact us.