Increase Your Impact with a Stock Gift

Gifts of Appreciated Stock—A Smart Way to Give

Appreciated stock, held for more than one year, can be the ideal choice for individuals who want their charitable gifts to make the biggest impact for the lowest possible cost. The secret ingredient: double tax benefits.

Suppose Ava gives us 100 shares of stock with a current fair market value of $5,000. She purchased the stock 10 years ago for $1,000. Today, Ava can deduct the full $5,000 on this year’s income tax return if she itemizes. The $4,000 capital gain is not taxed, even though the gain is quadruple the purchase price. Owing no capital gains tax and receiving an income tax deduction allows Ava to give stock at the lowest possible after-tax cost.*

Which Stocks Are Best to Give?

The best choices depend on your portfolio, investment goals, and taxes. There are no definite rules for suitable stocks, but there are a few guidelines:

- Stocks must have been held for more than one year to deduct the appreciation.

- Stocks with the greatest amount of appreciation provide the most leverage for the untaxed gain.

- Investors who follow set portfolio ratios (e.g., 40% stocks, 40% municipal bonds, and 20% cash) might choose to give a stock that would help reposition investments, balance ratios, and provide valuable tax

- A stock that lowered or cut its dividend might be a good

Opportunities to Give and Increase Income

In addition to outright gifts, individual stocks are also an excellent choice for funding life income gift plans. This makes an easy gift with little to no problem in valuation. What’s more, life income gifts generate substantial tax benefits in the year they are made and provide you with an attractive income for life or a term of years. Some life income gifts even provide a choice between a fixed and variable income.

Let’s look at the two main reasons for using appreciated stock to fund a life income gift plan.

Increase income

Investors may hold stocks that pay low dividends. Suppose you want more income for retirement. If you sell appreciated stock and reinvest the proceeds to achieve a higher yield, there is a capital gains tax liability—possibly as high as 23.8% (20% capital gains tax rate plus the 3.8% Medicare surtax on investment income).

A better strategy for those who are charitably inclined might be to fund a life income gift plan with stock. A gift of low-paying dividend stock provides relief from the capital gains tax, and the full value of the stock is used to determine the payout of a life income gift. You also qualify for a substantial income tax charitable deduction, which further improves cash flow. Most important, you get the personal satisfaction of knowing that your gift will have an impact on our work.

Rebalance a portfolio

Individuals at or near retirement frequently become more conservative. As aging investors become less interested in risk, they redefine their investment objectives and often find they need to rebalance their portfolios.

Suppose Doug has an investment objective that calls for 40% equities and 60% in low-risk, low-return investments. When investment gains cause equities to rise to 50% of the portfolio, Doug must sell stock to rebalance. However, this sale can trigger a hefty and unwanted capital gains tax. Alternatively, Doug could use the excess stock to set up a life income gift plan. This strategy lets Doug pay no immediate capital gains tax, reduces his income tax, rebalances the portfolio ratios, and makes an impact by furthering our mission.

* All examples are for illustrative purposes only.

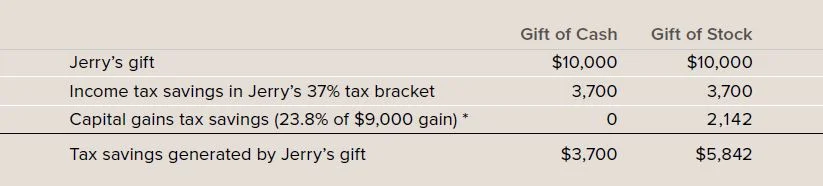

GIFT OF STOCK VS. CASH GIFT: AN EXAMPLE

Jerry usually gives us a $10,000 check at year end.

This year, he decides to donate stock worth $10,000 that he purchased eight years ago for $1,000. If he itemizes, he can take the full $10,000 charitable deduction for his gift even though the $9,000 capital gain has never been taxed. In his 37% tax bracket, the tax savings are substantial.

* High-income taxpayers with more than $200,000 in income (or married couples with more than $250,000) face a capital gains tax as high as 23.8% (20% capital gains tax rate, plus the additional 3.8% Medicare surtax on investment income).

Note that what donors save in taxes increases in proportion to the amount the stock has appreciated in value. Also keep in mind that donors must have owned the stock for more than one year. While Congress has provided additional tax savings to encourage gifts of appreciated stock, not everyone is aware of this opportunity. Now may be a good time to explore how to make a greater difference with your giving. Gifts of appreciated stock are simple—so easy that we can give you the details over the phone.

Can a Gift of Stock Benefit You?

It’s easy to find out. Simply call or email us and we’ll be happy to answer all of your questions. You can also request a free, no-obligation illustration that will spell out the anticipated financial and tax benefits of a hypothetical gift. It would be our privilege to provide you and

your advisors with the information you need to choose a gift that ensures you enjoy maximum benefits and personal satisfaction from your generosity.

ANNUAL LIMIT ON DEDUCTING CHARITABLE GIFTS OF STOCK

The maximum amount you can deduct in a single year for donations of long-term appreciated property is 30% of adjusted gross income. You can carry over any amount that can’t be deducted in one year into the next tax year (up to five years total).